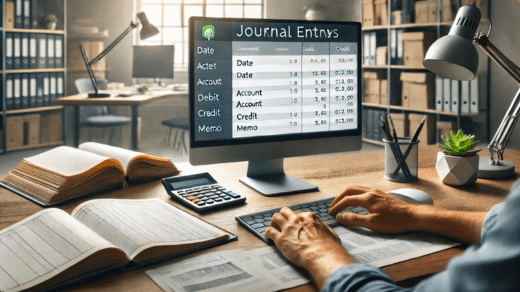

Journal entries are a core feature of QuickBooks Online (QBO), used to record complex financial transactions that don’t fit into standard transaction categories like invoices, bills, or expenses. Whether you’re adjusting accounts, correcting errors, or allocating income and expenses, journal entries help ensure your financial records remain accurate and complete. This step-by-step guide will walk you through creating journal entries in QuickBooks Online, providing you with a clear understanding of how to record and manage these essential accounting adjustments.

What Are Journal Entries in QuickBooks Online?

Journal entries in QuickBooks Online allow you to manually adjust debits and credits across different accounts, providing a balanced way to handle specific accounting needs. Some common uses for journal entries include:

- Adjusting Expenses or Income: Allocate or reclassify revenue and expense amounts across different accounts.

- Correcting Errors: Fix mistakes in previously recorded transactions by adjusting debits and credits.

- Recording Depreciation: Account for asset depreciation by recording periodic adjustments.

- Allocating Payments: Track owner’s equity, dividends, or investment distributions accurately.

Step-by-Step Guide to Creating a Journal Entry in QuickBooks Online

Follow these steps to create journal entries in QuickBooks Online easily and accurately:

Step 1: Log In to QuickBooks Online

Log into your QuickBooks Online account and ensure that you have the necessary permissions to create journal entries. Only users with accountant or administrator access can create these entries in QBO.

Step 2: Navigate to the Journal Entry Option

From the QBO dashboard, click on the + New button on the left-hand menu to access the transaction options. Under the Other category, select Journal Entry. This will open the journal entry screen where you can input the details.

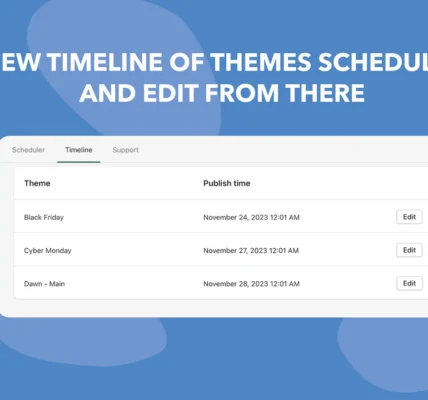

Step 3: Set the Journal Entry Date

In the journal entry screen, enter the Date for the transaction. Make sure this date aligns with the period in which the entry should be recorded. Correct dating is crucial for accurate reporting, especially if your business closes books quarterly or annually.

Step 4: Enter the Relevant Accounts

In the first row, select the Account that needs to be adjusted from the drop-down menu. This could be any account from your Chart of Accounts, such as an income account, expense account, or liability account.

Step 5: Input Debit and Credit Amounts

Next, input the Debit and Credit amounts for each account. Remember that total debits must equal total credits for the journal entry to balance, ensuring your books remain accurate. QuickBooks Online will alert you if the entry is unbalanced, helping you maintain consistency in your records.

For example:

- To increase an asset account, you would typically debit it.

- To increase a liability or income account, you would typically credit it.

Step 6: Add Descriptions and Memos

Each line in the journal entry has a Description field where you can provide additional context for the entry. This can be particularly helpful if you’re revisiting the entry later or if an auditor reviews your records. Use the Memo field to add any overall notes about the entry, especially if it relates to a particular transaction, correction, or adjustment.

Step 7: Assign Customer, Vendor, or Class (Optional)

For businesses that use class tracking or need to associate journal entries with specific customers or vendors, QuickBooks allows you to assign each entry to a Customer, Vendor, or Class. This feature is useful for businesses that track costs across multiple projects, departments, or locations.

Step 8: Review and Save the Journal Entry

Before saving, review all fields carefully to ensure the amounts, accounts, and descriptions are accurate. Once you’re confident everything is correct, click Save and Close to finalize the journal entry. QuickBooks will automatically update your accounts, reflecting the new adjustments in your financial reports.

Tips for Managing Journal Entries in QuickBooks Online

- Double-Check Entries for Accuracy: Ensure that total debits equal total credits, and verify that the accounts and amounts are correct. Errors in journal entries can impact your financial reports, so accuracy is essential.

- Use the Audit Log: QuickBooks Online has an Audit Log feature (found under Settings) that tracks every change, including journal entries. This log can help you monitor any adjustments made to your books over time.

- Consider Saasant for Bulk Entries: If your business handles high transaction volumes, consider using Saasant for bulk entries. Saasant integrates with QuickBooks Online to allow for bulk journal entries, making it easier to manage and record large amounts of data efficiently.

When to Use Journal Entries

Journal entries should primarily be used for adjustments, corrections, or specific accounting transactions that aren’t captured by other QuickBooks transaction types. For everyday expenses, revenue, bills, or invoices, use the appropriate transaction type within QuickBooks instead of a journal entry, as this helps with better categorization and tracking of routine transactions.

Final Thoughts

Creating journal entries in QuickBooks Online is an essential accounting task that allows businesses to maintain accurate financial records and make necessary adjustments with ease. By following this step-by-step guide, you’ll be able to enter and manage journal entries efficiently, ensuring your financial data remains balanced and reliable.

For businesses that require frequent or high-volume adjustments, tools like Saasant can further streamline the process, making it easier to handle multiple journal entries at once. Mastering journal entries in QuickBooks gives you greater control over your accounting and enables you to keep financial records precise, organized, and ready for analysis.